Definition stock options executive compensation induce risk-taking

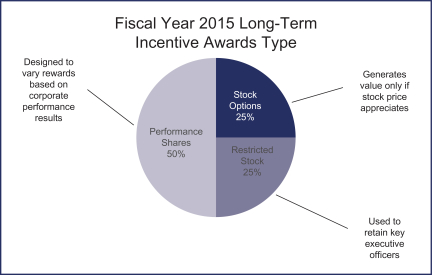

Stock options are a critical element of CEO compensation — making up one quarter of total pay for executives these days. But what does that mean for the risk profiles of the companies those CEOs lead?

At the heart of that question are two opposing forces: That tends to dampen risk taking because CEOs want to preserve the value of those options. At the same time, however, the downside of risk taking is limited because once the options are worth zero, they do not decline further in value if the stock price falls. And that limited downside increases the tendency to take on risk. A recent paper co-authored by Wharton finance professor Todd A. Gormley studied this issue by examining what steps CEOs took when hit with a sudden increase in business risk.

The overall impact of options is an increase in risk taking by company leaders. To definitively answer the question of how options impact risk taking, Gormley and his authors had to control for one issue. If companies that relied heavily on options to compensate top managers had higher risk, there are two possible explanations.

One is that the options created a greater appetite for risk.

But the other possibility is that the boards of companies facing heightened risk tended to rely more heavily on options-based payouts for CEOs. To strip out this possible factor, Gormley and his co-authors decided to look at a universe of companies with set compensation arrangements that were hit by an unexpected increase in their risk profile.

Having the introduction of a major new risk eliminated the question of whether riskiness caused heavy reliance on options. At the same time, the firms faced the possibility that use of a newly listed chemical would be restricted by the government, a step that could disrupt manufacturing operations and increase costs as the companies scrambled to find a substitute.

Those hits posed a real threat — the affected firms faced a fold increase in the probability that they would become financially distressed. Department of Health and Human Services publishes a report roughly every two years that looks at all compounds that may be cancer causing in humans and to which a significant number of Americans are exposed.

Gormley and his colleagues zeroed in on chemicals that were added to that list in , , , and At the same time, all the potential impacts of a new carcinogen labeling were long-term: Regulatory changes and payments to injured employees typically play out over years.

As their next step, then, the authors examined the strategies the companies chose to employ. The question was whether the use of that risk-reducing strategy would differ depending on whether the CEO had an options-heavy compensation package or one with relatively little in the way of options-based pay.

The authors then identified companies in industries with observed exposures to newly listed carcinogens for which they could find detailed CEO compensation figures.

In the end, they concentrated on 69 firms. The researchers found another group of firms — in all — that were in similar industries but unaffected by any new carcinogen labels. While not all instances of substances being labeled carcinogens make front page news, they clearly pose a real risk to the companies involved. Trichloroethylene was labeled a possible cancer causing agent in , for example. The group studied the impact of a newly labeled carcinogen, like trichloroethylene, a number of ways.

First, they looked at companies in industries where employees had been exposed to a chemical recently tagged as potentially cancer causing versus firms in industries that did not have exposure. The question was whether firms with a potential exposure would try to cut their risk by stabilizing their cash flow.

A further analysis of mergers and acquisitions activity during the period revealed that the key mechanism for slashing cash flow volatility was diversifying into new businesses. Given that the typical response to a major new headache was to eliminate nasty swings in cash flow, the researchers then asked whether options-based compensation changed that equation. They cut the group of companies where workers were exposed to a potential carcinogen into two segments: Those where the CEO received a lot of options, and those for which CEO compensation had a below-average use of options.

DIRECTORS’ CARE AND DUTY IN CASE OF BREACH

In the first case, where the CEO had an options-heavy package, cash flow volatility did not change and was similar for firms that had no exposure to the chemicals. Those CEOs did not try to cut risk in response to the new potential liability. But firms where CEOs had relatively few options did, in fact, cut their cash flow volatility — a clear signal they were taking risk-reducing steps.

Upon digging deeper, the co-authors found that firms where executives had options that were in the money — or options more akin to straight equity — took steps to cut risk more than those whose executives had options that were out of the money. If options tend to increase risk taking, the next question is whether that is better for shareholders. The answer is unclear, Gormley says. And morale was very low. Even without [firms] going into bankruptcy, those financial problems can destroy a lot of value.

In that kind of situation, diversifying into other businesses may offset some of that.

But in other cases, when those additional pressures are not present, diversifying may mean moving into businesses where you have little expertise — something that can hurt shareholders.

Gormley points to the case of defense contractor General Dynamics as an example of risk paying off. When the defense industry was in decline in the s, General Dynamics bucked the trend of diversifying into new businesses.

Though a diversification strategy would have cut risk, General Dynamics instead downsized and remained focused on defense.

The Making of a Daredevil CEO: Why Stock Options Lead to More Risk Taking - Knowledge@Wharton

According to Gormley, the research also sheds some light on the recent financial crisis. One question that has loomed large in the aftermath of the recession is whether the way financial firms structured compensation helped to drive some of the reckless behavior that led to the economic meltdown.

Research has shown that senior executives at financial firms have a large part of their compensation in the form of restricted stock — securities that, like straight equity, tend to reduce risk taking. But at the lower levels of those firms — areas like sales and trading — a large chunk of compensation is tied to bonus pools. Like options, those bonus pools have a large upside and limited downside. After all, once the pool is worth zero, managers have little to lose.

That sort of compensation does, in fact, encourage risk taking, Gormley notes. The research provides important information for the boards of directors of U. But if you want to discourage risk taking, you would give fewer options and more stock. Financial reforms in China lag far behind the country's outsized impact on the global economy. How far and how fast should its global financial integration go? Amazon's purchase of Whole Foods expands its presence in the grocery space, but could also provide a boost to the company across multiple sectors.

Wharton professor and analytics expert Peter Fader joins WNS executives Raj SivaKumar and Mike Nemeth to discuss the power of harnessing customer analytics for business success. Log In or sign up to comment. All materials copyright of the Wharton School of the University of Pennsylvania. Wharton, University of Pennsylvania The K W Network: Finance The Making of a Daredevil CEO: Why Stock Options Lead to More Risk Taking Jul 06, North America.

How Far, How Fast Financial reforms in China lag far behind the country's outsized impact on the global economy. What Whole Foods Brings to the Table Amazon's purchase of Whole Foods expands its presence in the grocery space, but could also provide a boost to the company across multiple sectors.

Sponsored Content Leveraging Customer Analytics for Business Success Wharton professor and analytics expert Peter Fader joins WNS executives Raj SivaKumar and Mike Nemeth to discuss the power of harnessing customer analytics for business success.

Join The Discussion No Comments So Far Log In or sign up to comment. Knowledge Wharton Partners View All Partners Partner Collaborations Become a Content Partner. Podcasts Hear what CEOs, Wharton faculty, and other commentators have to say about the latest business trends, breaking news and market research in their own words.

About Knowledge Wharton Become a Content Partner Privacy Policy Feedback All materials copyright of the Wharton School of the University of Pennsylvania.