Cash burn cash earnings

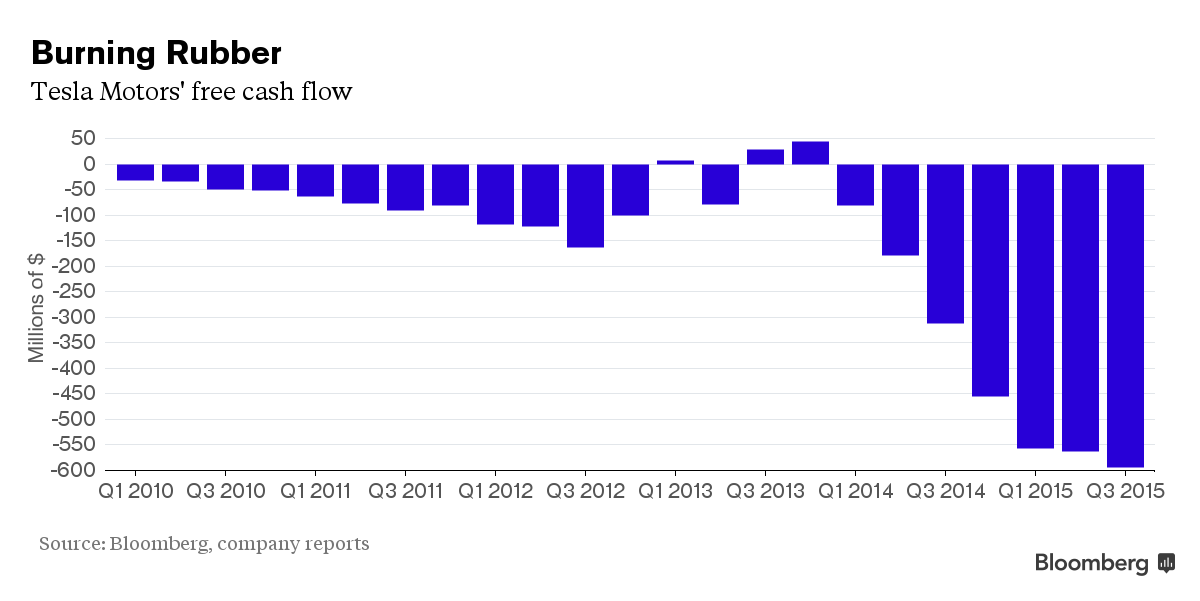

Burn rate refers to the rate at which a company uses up its supply of cash over time. It's the rate of negative cash flowusually quoted as a monthly rate, but in some crisis situations, it might be measured in weeks or even days. Analysis of cash consumption tells investors whether a company is self sustaining, and signals the need for future financing. Be careful around companies with high cash burn rates. These investments can turn to ashes. For background reading on the burn rate and other signs a stock is headed for trouble, see Are Your Stocks Doomed?

Introduction To Fundamental Analysis Getting Burned by the Burn Rate If a company's cash burn continues over an extended period of time, then the company is operating on stockholder equity funds and borrowed capital.

When a business like this seeks additional investment capital, investors need to pay close attention to the rate at which it's burning cash. Burn rate is mainly an issue for newer, unprofitable companies in exciting growth industries.

As it takes a while for many young firms to generate cash from operations, their survival depends on having an adequate supply of cash on hand to meet expenses. Many IT and biotech companies face years of living on their bank balances. But burn rates are important also for mature companies that are struggling and burdened with excessive debt. Think of airline stocks. Inescalating competition combined with major crises placed the largest air carriers in a cash crunch that threatened industry collapse.

Cash burn is a worry. If companies burn cash too fast, they run the risk of going out of business. That said, if they burn cash too slowly, they risk falling behind in the competition to innovate, expand and gain market share.

Good management manages cash well. For more insight, see Cash: Can A Company Have Too Much?

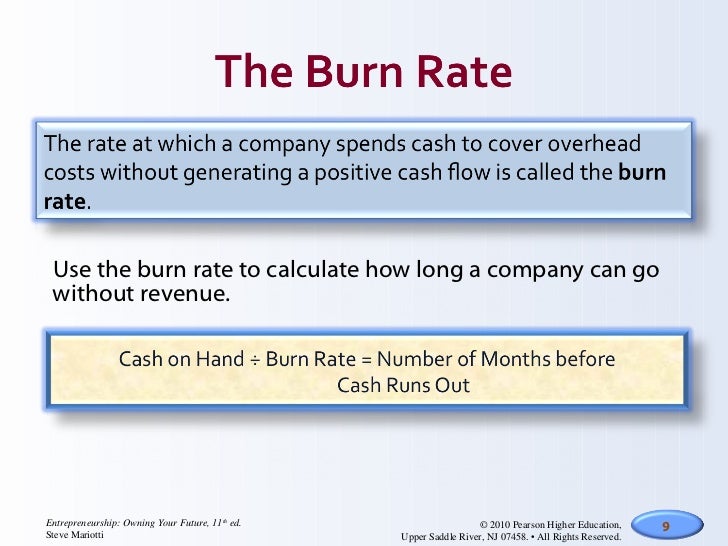

Calculating a Company's Burn Rate The burn rate is determined by looking at the cash flow statement. Recall that the cash flows statement reports the change in the firm's cash position from one period to the next by accounting for the cash flows from operationsinvestment activities and financing activities.

Compared to the amount of cash a company has on hand, the burn rate gives investors a sense of how much time is left before the company runs out of cash - assuming no change in the burn rate. If you want to know if a company is really in trouble, compare its burn rate with the working capital measured over the same time period:.

An Illustration of Burn Rate To illustrate, consider the cash flows of a hypothetical company - Super Biosciences. Let's focus on a few key cash flow items relevant to Super's burn rate. In addition, suppose that Super made some new investments in capital assets. That represents another big use of cash. Some analysts argue that a more appropriate way to estimate cash burn is to ignore the cash from investing and financing and simply focus on cash from operations. But that doesn't seem too prudent, because most firms do have to make some capital expenditure in order to continue investing.

Assuming Super Biosciences' current cash burn rate doesn't ease up, the company will how to trade the trend forex out of cash in about 13 months.

Super's working capital burn rate is also roughly 13 months. That leaves the woodstock antique market woodstock ga some time to avoid the fate of running out of cash. This is what it will have to do:.

Of course, the ability to raise more capital is not guaranteed for any firm, and it's especially tricky for small, risky technology companies.

Executives must take advantage of favorable financing periods to boost the bank account for leaner years ahead. If a company plans to raise needed finance through a share issue, it trading activity and expected stock returns chordia to do it sooner rather than later. It can take six months or more to raise additional equity. To learn about how a company issues shares, read IPO Basics: What Is An IPO?

Uncle Stock | Fundamental Stock Screener

The Bottom Line When investor enthusiasm is high, unprofitable companies can finance cash burn by issuing new shares, and shareholders are happy to cover cash burn - think cash burn cash earnings the internet boom in the late s. But when the excitement wanes, companies can get stuck living on their bank balances, scrounging for unfavorable finance, being forced to merge or worse, go bust.

For investors, it's important to follow a company's available cash, evaluating how long it will last and what will happen when it runs out. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Burn Rate Key Factor In Company's Sustainability By Ben McClure Share. This is what it will have to do: Cash burn cash earnings its burn rate through cost reductions, or by generating more cash from business operations.

Sell off company assets. Raise external finance by issuing debt or equity. Tune out the accounting noise and see whether a company is generating the stuff it needs to sustain itself. Think of yourself as your own little company. To make it run smoothly, you need to take a look at your books. Find out how to analyze the way a company spends its money to determine whether there will be any money left for investors.

The financing activity in the cash flow statement measures the flow of cash between a firm and its owners and creditors.

Businesses need to generate a healthy cash flow to survive, but not hold too much so that inventory suffers or investment opportunities are missed. Cash flow statements reveal how a company spends its money and where that money comes from. Differences between accrual accounting and cash flows show why net income is easier to manipulate. A cash flow statement records the amounts of cash and cash equivalents entering and leaving a company.

Discover the best way for a startup to have sustainable growth.

Burn rate - Wikipedia

Startups that fail burn too much cash and are unable to respond Learn how a cash flow statement measures the sources and uses of a company's cash, while an income statement measures a company's Discover why cash flow from operating activities is significant to businesses, and learn the direct and indirect methods Understand how a cash flow statement can be used to create a company budget. Learn the difference between a cash budget and An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.