Tax consequences of selling covered call options

Covered call writing has federal tax implications, whether the strategy wins or loses.

When trading in stock options, it behooves the investor to know the federal income tax laws. The IRS is mindful of any income earned from options trades, including the short-term strategy of "covered calls.

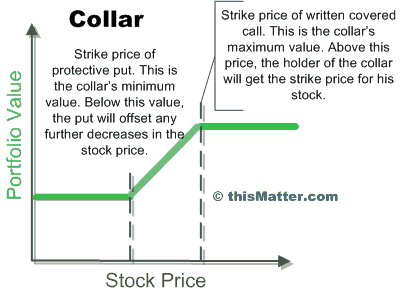

Stock options are publicly traded contracts to buy or sell shares of stock at a certain "strike price" and before a fixed "expiration date. The call option itself can be bought or sold. Selling or "writing" a call option results in an immediate gain. When the investor owns the stock itself as well, the strategy is known as a covered call.

Writing "naked" calls -- when you don't own the underlying stock -- is a risky strategy.

If you sell a call without owning the stock, you could lose an unlimited amount of money if the stock rises and the option price rises with it. At the expiration, you must close the trade by buying the expensive call back -- thus taking a big loss. If your call is covered by stock that you own, you're not risking anything if the stock rises.

Your loss on the option is covered by the price rise in the stock, which will be sold at expiration if the share price is above the strike price. If you sell the stock before expiration, however, you put yourself into a naked call position. Investors like covered calls for this important safety feature: If the strike price stays above the share price, the option expires worthless and you keep the money you earned by selling the option.

The IRS considers any stock trade that opens and closes in less than a year as a short-term capital gain or loss. Your basis in the trade is the price you paid for the shares of stock, plus any transaction costs. The sales proceeds are the funds you receive for selling the stock, minus commissions and costs, if the stock is sold when the option expires.

Whether an option is considered held for the long term or the short term depends on the outcome of the trade. The basis for the covered call option is the price at which you buy the call back if you close the trade before expiration.

Why You Need to Trade Options - Live Trading Example on Selling a Covered Call on Shares of StockThe proceeds are the funds you receive when you open the trade by selling the call. Whenever you write a call that expires worthless, you report the amount you received for the call as a short-term capital gain, no matter how long the trade stayed open. For the stock itself, you report a long-term capital gain if you held the shares for more than a year, and a short-term gain if you held them for less than a year.

The tax impact of selling calls

If the option is exercised and your stock is purchased at expiration, you add the amount you received from the call to the proceeds from the sale of stock. You report capital gains and losses on Form , Schedule D, and Form Brokers don't normally break down option trades on the Form they issue you, so the record-keeping is up to you.

What's a Covered Call? The Strategy Writing "naked" calls -- when you don't own the underlying stock -- is a risky strategy. Tax Implications The IRS considers any stock trade that opens and closes in less than a year as a short-term capital gain or loss.

USAA Tax Center

Long-Term and Short-Term Gains Whenever you write a call that expires worthless, you report the amount you received for the call as a short-term capital gain, no matter how long the trade stayed open. Option Exercises and Stock Assignments SmartMoney: Can I Hedge a Call Option With a Put Option?

Bull Call Spread The Variables That Drive a Stock Option's Value How to Determine Strike Price for a Covered Call. Stock Options Explained in Plain English Can Covered Calls Be Sold in an IRA Account? Tax Treatment of Selling Put Options How to Trade Leveraged Stock Options.

Tradable Stock Options Taxes on Stock Option Premiums Risky Option Strategies How to Report the Sale of Stock Call Options.

Stocks, Options, Taxes: Part VI - Options And Tax Straddles, Covered Calls | Seeking Alpha

More Articles You'll Love. Stock Options Explained in Plain English. Can Covered Calls Be Sold in an IRA Account? Tax Treatment of Selling Put Options. How to Trade Leveraged Stock Options. Taxes on Stock Option Premiums. How to Report the Sale of Stock Call Options.

Qualified Covered Calls—Special Rules - omotohu.web.fc2.com

Bull Put Spread Vs. The Variables That Drive a Stock Option's Value.

How to Determine Strike Price for a Covered Call. Why Is a Call Option Called a Call?

About Us Careers Investors Media Advertise with Us Check out our sister sites. Privacy Policy Terms of Use Contact Us The Knot The Bump.