Best bollinger band trading system

May 16, Forex Trading Articles. These days there are many different indicators available for trading the Forex market. And it seems every few months or so a new trading indicator arrives on the scene. But many times, these new indicators are just some variation of the classical versions. Today we will discuss one of the most robust trading indicators that has stood the test of time.

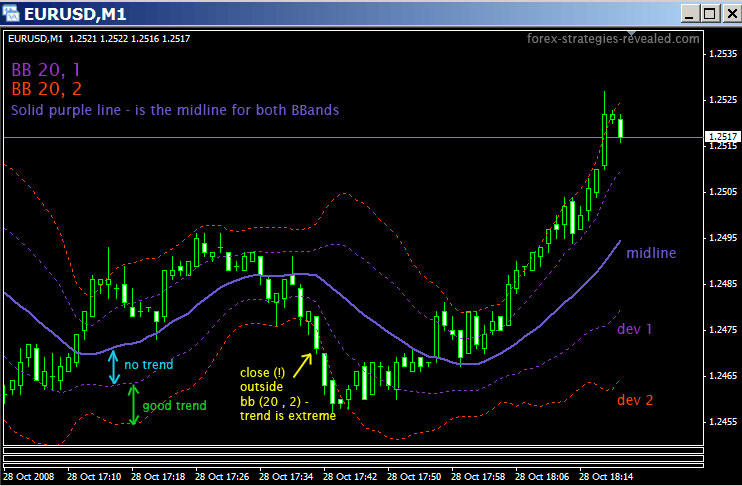

This is the Bollinger Bands indicator. We will discuss the basic elements of this indicator, and I will introduce you to a few profitable Bollinger Band trading strategies. The Bollinger Band is best described as an on-chart volatility indicator. It consists of upper and lower bands which react to changes in volatility. The two bands wrap around the price action at the upper and the lower extremes.

When the volatility of a given currency pair is high, the distance between the two bands will increase. When the volatility of a given currency pair is low, the two bands begin to compress together. The indicator includes a standard period Simple Moving Average which could be used to set entry and exit points of trades.

As we noted, the Bollinger Bands trading tool consists of three lines — upper band, lower band, and a middle line. The middle line is a period Simple Moving Average. It is calculated by summing the closing prices of the last 20 periods and then dividing the result by The upper line is calculated with a period SMA of the price action and its standard deviation. The lower band is calculated the same way, using the period SMA and its standard deviation.

The default standard deviation used is 2. Although it is a primarily a volatility indicator, the Bollinger Bands is quite useful in discovering support and resistance areas. There are a few signals that can be generated using the Bollinger Band.

Top 6 Bollinger Bands Trading Strategies

These signals respond to different price attitudes on the chart. When the Bollinger Bands are close to each other, then the trading indicator is conveying to us that the volatility of the Forex pair is relatively low. In this manner, the trading volumes are typically low as well, and the pair is said to be consolidating or ranging rather than trending. In most cases, we should avoid trading within very tight price ranges, because they provide significantly less profitable opportunities than during trending phases.

The image below shows a classical Bollinger Bands Squeeze. An important concept to understand in forex trading is that prices will typically move from periods of low volatility to periods of high volatility and back again. As you see, after the squeeze, the prices breaks out to the downside, and enters a sustained downtrend.

The Bollinger band squeeze breakout provides a good premise to enter the market when the price extends beyond one of the bands. This would provide for support in favor of the range bound market coming to an end and the likelihood of price entering into a new trend phase.

As a result, a bullish bounce could occur, creating a long trading opportunity. Think of this as a hidden support level based on an extreme volatility reading.

However, if the price starts falling quickly at the lower band instead, and the distance between the two bands continues to increase, then we must be careful of entering a long trade. When the bands are expanding and we see strong price momentum below the lower band, this is a clue that a bearish bias should still be in play. The same scenario is in force but in the opposite direction. We look at the upper band as a hidden resistance level based on an extreme volatility reading.

However, if the bands expand and the price starts closing candle after candle above the upper band, then we expect further bullish expansion.

25. How to Trade Bollinger Bands - Stocks, Futures, ForexThe breakout in the Bollinger Bands Moving Average is a confirmation signal, which usually comes after a price interaction with the bands. If the price bounces from the upper band and then breaks the period SMA in bearish direction, we get a strong short signal.

If the price bounces from the lower band and breaks the period SMA upwards, then we get a strong long signal. In this manner, the period SMA breakout can be used to set exit points after entering a Bollinger Bands trade.

The black arrow points out a Bollinger Bands squeeze. The red arrow shows the price trending while breaking the lower Bollinger Band and the green arrow shows up trends on the upper Bollinger Band. Now that we are familiar with the structure and the signals of the Bollinger Bands, it is now time to shift our focus a bit, and take a look at a couple of trading strategies that can be incorporated using the Bollinger Bands.

One reliable trading methodology utilizing Bollinger Bands, is combining Bollinger Bands and Candlestick analysis. Basically, you could go long after the price touches the low Bollinger Band and then closes with a reversal candlestick pattern. And on the flip side, you could short the Forex pair when the price hits the upper band and then forms a reversal candle. For this setup, you should place a stop loss order beyond the reversal candlestick.

I prefer to close half of the trade when the price reaches the Bollinger Bands Moving Average. We can stay in the trade for the other half of the position to take advantage and any prolonged price move. And so in this case, if the price keeps trending in our direction, we can use the Bollinger Bands Moving Average Breakout as an exit signal.

Just close the trade right away instead. This chart illustrates a long position initiated by a reversal candlestick chart pattern. The big black arrow on the chart shows a Bollinger Band squeeze. The bands are relatively close to each other squeezing the price action and the indicator. Afterwards, the price starts to decline. Suddenly, the bands start expanding rapidly during the decrease.

Soon we see the price action creating a bullish Tweezers reversal candlestick pattern, which is shown in the green circle on the image.

A stop loss order should be placed below the lowest point of the Tweezers chart pattern as shown on the image.

Tales From The Trenches: A Simple Bollinger Band® Strategy

The price then starts increasing. The price continues its rally. On the way up we see a few reversal candle patterns. However, they are not confirmed and we disregard them as a potential exit point of the trade. At the end of the price increase we see a Doji reversal candle pattern, which is followed by two bigger bearish candles.

The close of the second bearish candle could be taken as the first exit of the trade Full Close 1. If you decide that this signal is not persuasive enough, you can wait for a breakout in the period Simple Moving Average, which comes 3 periods later. I would prefer to use the Doji reversal followed by the two bearish candles as an exit point.

Even if you think the signal is not persuasive enough it comes 8 hours before the weekly market close. Therefore, this looks like the better option to exit this trade. This way you are protected against weekend risk and big gaps with the Monday opening. In this example, if you decided to wait, you would have fell victim to a 30 pips bearish gap.

In this trading strategy we will approach situations when the price goes beyond the upper or the lower Bollinger Band. At the same time, the bands should be expanding, which indicates higher volatility. Furthermore, we will include the Volume Indicator in order to enter trades only if volumes are high, or currently increasing with the direction of the trend.

Forex Trading Strategies Revealed | Beginners and Advanced Traders

If all these requirements are met, you can open a trade in the direction of the breakout. This tactic allows you to take advantage of rapid price moves caused by high trading volumes and high volatility. You should stay in these types of trades until the price breaks the period Bollinger Bands Moving Average in the opposite direction. Let me now show you how this Bollinger Band trading system works. The image illustrates a short trade opportunity based on signals from the Bollinger Bands indicator and the Volume Indicator.

At the beginning of the chart we see the price moving below the period Bollinger Band SMA. However, the two Bollinger Bands are very tight and the volumes are relatively low. Therefore, we would stay out of the market for the time being.

Suddenly, the two bands start expanding which is shown by the pink lines on the image. For this reason, we consider this as a nice opportunity for a short position in the Yen. You should always use a stop loss on this trade, and it should be located above the period Simple Moving Average. This would act as a trailing stop, which means that you would constantly adjust the stop in the bearish direction. According to our strategy, we should stay in the trade as long as the price is below the period SMA.

The range continues towards the period Simple Moving Average, which gets broken upwards on April Based on the rules of the strategy, this would be the exit signal and the trade should be closed out at this point. In my opinion, the better Bollinger Bands trading strategy is the second setup I showed you. The reason for this is that Volatility and Volumes are mutually connected.

Therefore, their importance to each other is essential, which in turn, creates reliable signals for trading. When the price is moving strongly beyond one of the bands during high volatility and high trading volumes, then we are likely to see a big price move on the horizon. In addition, the rules for entering and exiting a trade and clear and straight forward, which makes this Bollinger Bands strategy easy to implement.

The Bollinger Bands with candlestick patterns is a well-regarded strategy as well. However, it is less likely to produce a big price move. Some traders prefer this type of trade setup, which is quite fine, so long as the trader understands that this is more of a mean reversion strategy and requires stricter risk management controls.

Get My Forex Insider Newsletter filled with Exclusive Tips and Strategies. Download the short printable PDF version summarizing the key points of this lesson…. Click Here to Download.

Join My Free Newsletter Packed with Actionable Tips and Strategies To Get Your Trading Profitable….. Click Here to Join. Get My Forex Insider Newsletter filled with Exclusive Tips and Strategies Get Instant Access.

S Trade Balance Economic Report.