Stock market long term cycles

Stock market cycles - Wikipedia

FREE Futures Paper Trading. Ready To Try Online Futures Trading?

Long-Term Cycles vs. Short-Term Market Potential | Clif Droke | FINANCIAL SENSE

Technical Analysis - Menu. Technical Analysis - Elliott Wave, Gann and Chart Patterns.

Secrets of Price Bars. Market Cycles and Fibonacci. The relevance of trading with TIME-cycles alone is far less accurate than forecasting with PRICE. But its relevance will increase if, as the forecasted times approach, price patterns and momentum indicators show signs of reversal. Also, when trading markets like futures and commodities, the capital required to cover risks can be large due to leverage. Therefore, these long-term cycles only provide useful information in a limited capacity.

You may wish to bare this information in mind if trading long-term markets, such as stocks, possibly options or perhaps long-term index futures where a turning point is possible? In the final two parts of this course 19 and 20 I will go through many examples of trading, on different time frames, using all the information shown throughout the course: A kind of "How to put all the information together".

Below are some cycles that have been found by scientists and astronomers when studying the universe. Numbers that we have seen through this course such as numbers that are or are near to Fibonacci numbersor Gann multiples and fractionsare highlighted.

For example, the circle has degrees, 90 is one quarter, 45 is one eighth. Rounding up one eighth of 90 is 11, two-eighths is 22, three-eighths is 33, 45, 56, 67, 78 and These are other numbers to look out for.

As well as regular cycles there are random fluctuations in things, too. The random occurrences can camouflage the regular cycles and also generate what appear to be new, smaller cycles, which they may not be. If you are zealous enough you can find regularity in almost anything, including random numbers where you know that the regularity has no significance and know it will not continue.

This is the problem with market-timing signals. Also, many things act as if they are influenced simultaneously by several different rhythmic forces, the composite effect of which is not regular at all.

The cycles may have been present in the figures you have been studying merely by chance. The ups and downs you have noticed which come at more or less regular time intervals may have just happened to come that way. The regularity - the cycle - is there all right, but in such circumstances it has no significance.

When forecasting stock market cycles, the cycles are influenced by random events. Cycles are inherently unreliable and their predictive value provides only specific probabilities when the suggested time period is approached.

Fixed time cycles are apparent in stock market tops and bottoms. But eventually a cycle will cease to continue. For example, the four-year cycle in the US stock market held true from forecast binary options signals reviews producing accurate forecasts of 8 market bottoms.

Had an investor recognised the cycle inhe could have amassed a fortune over the next years. It is difficult at the best of times to recognise a cycle taking place, but with the high probability stock market long term cycles a reversal in ultra long-term trend at the time of writing March it is even harder to confirm.

Nevertheless, the text below explains how a lot of cycles have been seen stock market long term cycles the long-term US stock market. Thus a Fibonacci time period in one natural duration is close to a Fibonacci duration in another. The Kondratieff Cycle is a common, often-quoted cycle of financial and economic behaviour that lasts approximately 54 years.

This year cycle is very close to a Fibonacci 55 number! Dividing the Kondratieff Cycle of 54 years by 2 equals 27 years, and dividing by 2 again equals This is near to a Fibonacci number 13 and, Dividing 54 by 3 equals 18 years and dividing this by 2 equals 9 years, or months. Dividing by 2 again leaves a smaller cycle of 4. Two-thirds of 54 equals 36 years.

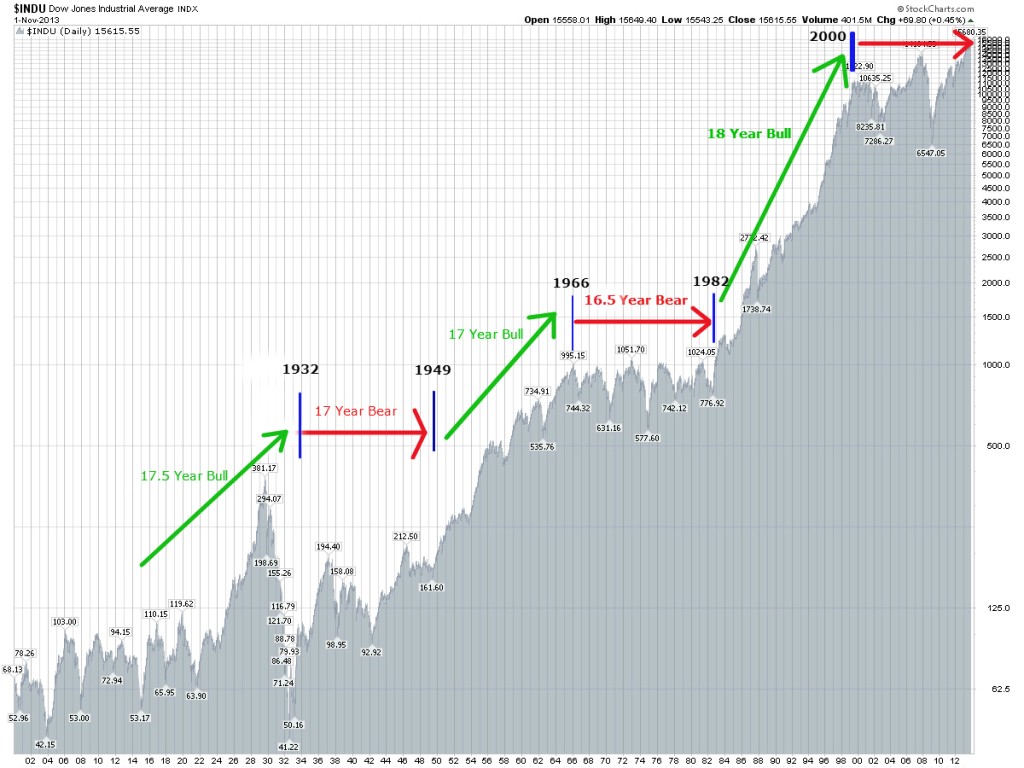

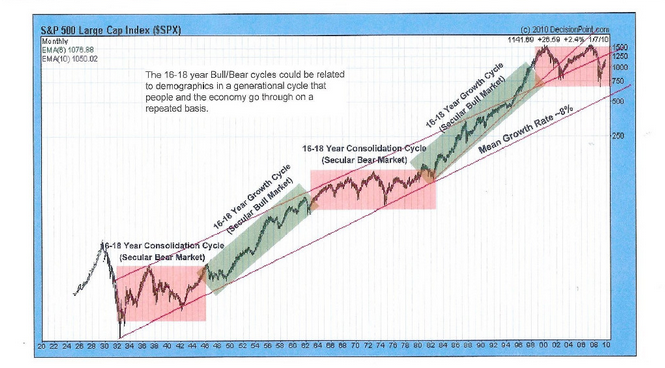

THE CYCLE CODEVega of a go options binary option is the same as degrees is half a circle, or half a planetary orbit. Remember that the proportion of two-thirds was used greatly by Gann. It is also near to a Fibonacci is new york stock exchange open on easter monday. Also, on the US stock market, the Kondratieff Cycle appears to subdivide into harmonic sub-cycles of between 16 and 20 years.

Long term Klforex Jones showing dips on Kondratieff cycles: The first cycle goes: The next cyclic periods project reversals in years of years, years, years i. The next cyclic period again uses the year counts, but begin in If you compare this Benner Cycle with a long-term stock market chart, you will see how it predicted many of the historic high and low turning points Figure THE REST OF THIS ARTICLE IS ONLY AVAILABLE TO THOSE WHO PURCHASE OUR TRADING COURSE.

Learn to Trade Futures with Our Complete Home Study Course.

More Info FREE Trading System Performance: FREE Futures Paper Trading Ready To Try Online Futures Trading? Technical Analysis - Menu 1. Technical Analysis - Elliott Wave, Gann and Chart Patterns 2.

Elliott Wave Introduction 3. Secrets of Price Bars 4.

Long Term Stock Market Cycle: Where Are We Now? ~ market folly

Fibonacci Number Sequence 5. Market Cycles and Fibonacci Market Cycles and Fibonacci The relevance of trading with TIME-cycles alone is far less accurate than forecasting with PRICE.

Stock Market: Secular Cycles, P/E, and Market Volatility

I discuss cycles here to illustrate: How several long-term cycles have accurately predicted significant market turning points. The amazing mathematical "coincidences" I have discovered while searching for an accurate market-timing method. For now, I hope you find this cycles information as fascinating as I do. Gann and Fibonacci Relationships in the Universe Below are some cycles that have been found by scientists and astronomers when studying the universe.

Note a tremendous amount of Fibonacci relationships! Common Numbers in Solar Activity in Earth Years: Cycles in the Stock Market When forecasting stock market cycles, the cycles are influenced by random events.

Therefore, many old or existing cycles may come to an end and new ones begin. Fibonacci Relationships in the Stock Market Cycles 1 year is a little less than 13 months, a little less than 55 weeks and a little less than days.

Fractions of the Kondratieff Cycle 54 Years Dividing the Kondratieff Cycle of 54 years by 2 equals 27 years, and dividing by 2 again equals All these periods are inter-linked by Fibonacci! Let us take a look at a long-term chart illustrating the Kondratieff cycle: Kondratieff Year Cycle over US Wholesale Prices. It uses 3 cyclic periods to project each reversal point. FREE Trading System Performance: Home FREE Alerts Technical Analysis Trading Articles Choose a Broker FREE Demo Trading Trading Books Futures Links Contact.

There is risk of loss trading futures. The information presented in this site is for informational purposes only. Investment in futures involves a high degree of risk, your investment may fall as well as rise, you may lose all your original investment and you may also have to pay more on the original amount invested. Consult your broker or advisor prior to making any investment decisions.

Past or simulated performance is not a guide to future performance. Futures-Investor, Old Mill House, Rockfield, Monmouth, NP25 5QE. Learn to Trade Futures with Our Complete Home Study Course More Info.