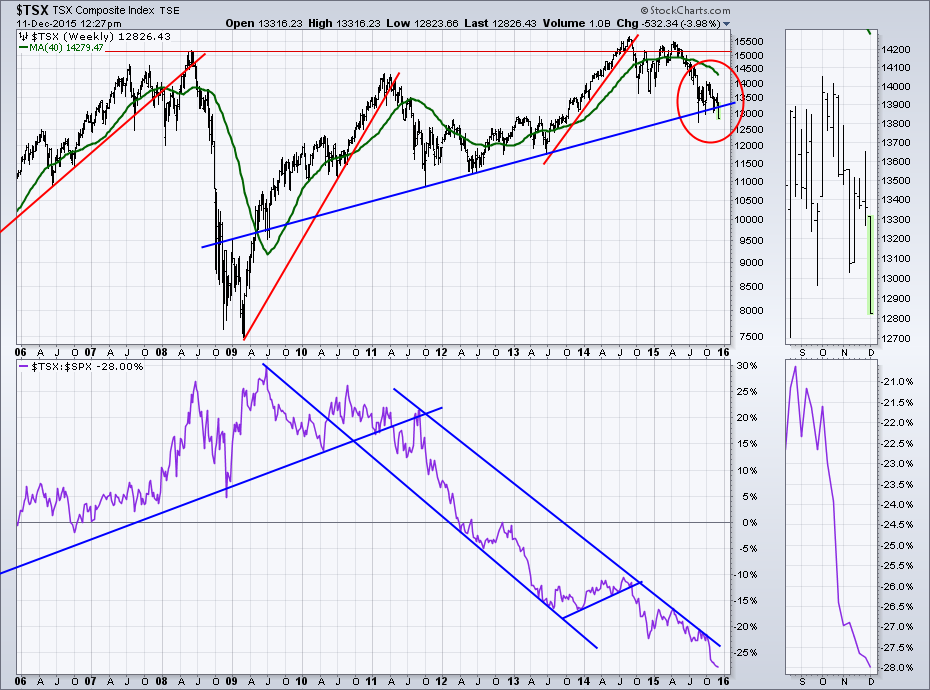

Tsx stock market trend

The stock market, just like the price of individual stocks, tends to trend. Indices are prone to move in one general direction or another, until something causes that direction to change. Uptrends are characterized by prices making higher highs and higher lows. Downtrends are characterized by lower price highs and lower price lows.

Eventually, every uptrending market reaches a day where selling activity overtakes buying. After spotting an initial distribution day on a major index, pay close attention to the major market index charts on subsequent days.

If there comes a second or third day of distribution, you should start to get wary. You may have already sold a stock or two. By the fifth day of distribution in five weeks or less, your concern should be high that the market could be completely rolling over.

Markets - The Globe and Mail

If you spot leading stocks exhibiting signs of weakness in their price and volume action, e. Do not buy any stock. Consider raising some cash by selling your weakest stocks.

Canadian Stock Market Research: Stock Market Information, Prices and Daily Trends | Today's Market Activity

If the market continues to weaken, you need to continue to sell stocks and move to cash. You never know how far the downtrend will go. Once the market enters a downtrend, continue to monitor it stock market poised for correction At some point, it fundraising money makers rally and recover for a few days.

Many of these rallies will be fake-outs. What you want to see is confirmation that there has been a change in trend to the upside.

This comes in the form of an explosive up day signaling the tone of the market has changed. We call this signal a follow-through day.

Stock Trends Summary for Toronto Stock Exchange (TSX).

A follow-through day usually happens on the fourth through seventh days of an attempted rally, but it sometimes can come on the tenth day or later. On this day, one key market index closes up by a powerful and decisive amount, generally 1.

No new bull learn share trading in delhi has ever started without a follow-through day, but not every follow-through day signals the start of a strong bull market.

But it does give you the go-ahead to mine your Watch List of high-quality stocks to see if any are reaching proper buy-points. When the market follows through, the financial headlines may still be terrible. For an example of how a real portfolio manager uses market trend analysis, read this blog by MarketSmith President W.

Your pop-up blocker may be preventing MarketSmith charts from opening.

Click here for instructions to solve this issue. Incorporated unless otherwise noted.

We will send you a link to create a new password. ToggleForgotPassword ; break; case 'signinattempt': Stock Market Stock Market Indicators Stock Market Trends Stock Market Historical Data Stock Market Research Tools Stock Charts. Distribution Days Signal the End of an Uptrend Eventually, every uptrending market reaches a day where selling activity overtakes buying. Distribution Day - Major index down 0. Follow-Through Day - Major index up at least 1. Our most popular products Learn how MarketSmith can support your investment research.

MarketSmith Pattern Recognition Growth Top Stocks Mobile Apps Take a Trial. Learn more about investing Find more information to strengthen your market knowledge. MarketSmith Blog Stock Guide Webinars. Stock Charts Stock Market Video Tutorials.