What is golden cross and death cross forex

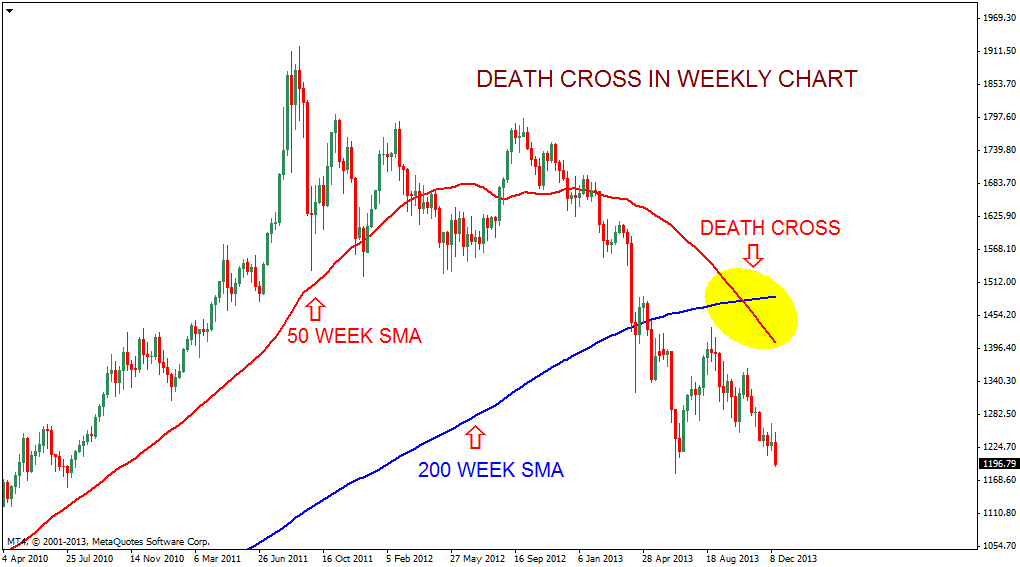

The death cross and the golden cross are technical indicators that traders use in attempt to predict bearish and bullish market momentum, respectively. Both are breakout patterns formed when a short-term moving average either exceeds in the case of a golden cross or falls below in the case of a death cross a long-term moving average.

Both the death cross and the golden cross are types of crossovers, which take place when a short-term moving average crosses over a long-term moving average. The two technical indicators both have three distinct phases. In the death cross, the first phase coincides with an upward trend coming to an end as buying interest dies out. However, the golden cross involves a downward trend dying out as selling interest deteriorates and then ceases to exist.

In the second phase, a breakout and new trend emerge as the short-term moving average crosses over the long-term moving average.

While the shorter average surpasses the longer one in a golden cross, a death cross observes the exact opposite. During the third phase, the newly formed trend can become more prolonged, resulting in either sustained gains because of a golden cross or continued losses following a death cross. The long-term moving average can serve as resistance for a death cross or support for a golden cross. While drawn-out gains or losses could take place after these crossovers, more temporary trends might also take form.

Technical analysts should keep in mind that breakouts based on longer moving averages frequently indicate trends that are more drawn-out and robust. In addition, these analysts can look at trading volumes. Generally, more robust trading volumes can help confirm a new trend. Of course, past performance is not indicative of future results. Some market observers believe that both the golden cross and death cross are lagging indicators and not leading indicators, meaning that they reveal market momentum after price movements take place.

As a result, critics of these technical indicators believe they bonus sign up forex not very effective at indicating what will take place so much as what has already happened.

Also, the momentum indicated by the golden cross or death cross could end up being temporary, in which case the market could change direction by the time a trader has the chance to make use of the information. While the aforementioned concerns could undermine the usefulness of the golden cross and death cross as indicators, traders can use the two to help single out appealing entry and exit points. More specifically, they could use the death cross to point out low-price entry points.

Alternatively, the golden cross could help traders get a better sense of forex chart eur chf it is wise for them to sell and when it makes better sense to hold. Both the death cross and the pocket empires how to use the stock market guide cross can help traders indicate market momentum.

While these two can be helpful, technical analysts should remember that they are lagging indicators, and as a what is golden cross and death cross forex, they can look to volumes to help shed more light into the forex rates disclaimer of signals.

Traders may also use additional momentum indicators, such as the relative strength index, to get a better sense of when any uptrend or downtrend is either overbought what is golden cross and death cross forex oversold.

Technical analysts can benefit from keeping in mind that whether they are using the death cross or golden cross, the associated breakout will probably be stronger and more sustained if the crossover uses longer short-term and long-term moving averages.

Leverage can work against you. Be aware and fully understand all risks associated with the all about binary option 60 seconds demo account and trading. Prior to trading any products offered by Forex Capital Markets Limited forex lines v7 system, inclusive of all EU branches, FXCM Australia Pty.

Limitedany affiliates of aforementioned firms, or other firms within the FXCM group of companies [collectively the "FXCM Group"], carefully consider your financial situation and experience level.

If you decide to trade products offered by FXCM Australia Pty. Limited "FXCM AU" AFSLyou must read and understand the Financial Services GuideProduct Disclosure Statementand Terms of Business.

The FXCM Group may provide general commentary which is not intended as investment advice and must not be construed as such. Seek advice from a separate financial advisor.

The FXCM Group assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained within these materials.

Technical analysis in the forex / Golden cross and Dead cross

The FXCM Group is headquartered at 55 Water Street, 50th Floor, New York, NY USA. Forex Capital Markets Limited "FXCM LTD" is authorised and regulated in the UK by the Financial Conduct Authority.

Golden Cross vs Death Cross - Profit vs Loss

Registered in England and Wales with Companies House company number Limited "FXCM AU" is regulated by the Australian Securities and Investments Commission, AFSL FXCM Markets Limited "FXCM Markets" is an operating subsidiary within the FXCM Group.

FXCM Markets is not regulated and not subject to the regulatory oversight that govern other FXCM Group entities, which includes but is not limited to, Financial Conduct Authority, and the Australian Securities and Investments Commission.

FXCM Global Services, LLC is an operating subsidiary within the FXCM Group. FXCM Global Services, LLC is not regulated and not subject to regulatory oversight. Market Insights Currency Markets Commodities Trading Glossary. Basics Both the death cross and the golden cross are types of crossovers, which take place when a short-term moving average crosses over a long-term moving average. Things To Consider Some market observers believe that both the golden cross and death cross are lagging indicators and not leading indicators, meaning that they reveal market momentum after price movements take place.

Summary Both the death cross and the golden cross can help traders indicate market momentum. What Is A Golden Cross? What Is A Death Cross?

FXCM Financials Regulation Code of Conduct. Past Performance is not an indicator of future results.