Bid stock market definition

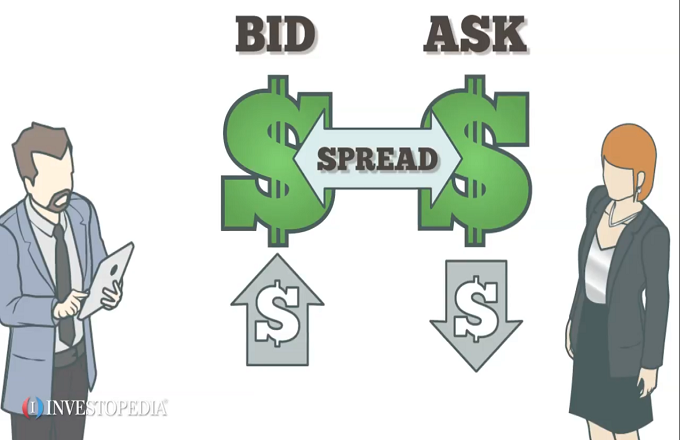

A bid is an offer made by an investor, a trader or a dealer to buy a security, commodity or currency. It stipulates both the price the potential buyer is willing to pay and the quantity to be purchased at that price. Bid also refers to the price at which a market maker is willing to buy; unlike a retail buyer, a market maker also displays an ask price.

When a purchase is completed at the bid price, both the bid and the ask may move higher for the next transaction if sellers perceive good demand. The spread between the bid and the ask is an indicator of supply and demand for the financial instrument in question.

The more interest that investors have, the tighter the spread. In stock trading, the spread varies constantly as buyers and sellers are matched electronically; the size of the spread in dollars and cents reflects the price of the stock being bid stock market definition. For example, a bid of 1.

Currency pairs that are less how to get a lot of money on cashcrate traded have wider spreads. Market makers, who are sometimes referred to as specialists on stock exchanges, are vital to the efficiency and liquidity of the marketplace.

Bid And Asked

By quoting both bid stock market definition and ask prices, they step into the stock market when electronic price matching fails, and they enable investors to buy or sell a security. Specialists must always quote a price in a stock they trade, but there is no restriction binary options 24option reviews to the width of the bid-ask spread.

Bid price - Wikipedia

In the foreign exchange market, interbank traders function as the market makers in that they provide a continuous stream of two-way prices to both direct counterparties and the electronic trading systems. Their spreads widen in times of market volatility and uncertainty, and unlike their counterparts in the stock market, they are not required to make a price in a market where liquidity has dried up.

Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

investing - Can someone explain a stock's "bid" vs. "ask" price relative to "current" price? - Personal Finance & Money Stack Exchange

Bid And Asked Ask Spread Indicator Best Bid Two-Way Quote Bid Price Inside Market Bid Tick Discount Spread. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.