Federal reserve stock market crash

Bonus Army Marchers Clash With Police In Washington, D. As we saw in the previous chapter, the Industrial Revolution kicked into high gear in the s as homes and factories plugged into the expanding electrical grid.

America was the leading workshop of the world, its consumers providing a seemingly insatiable appetite for new products and goods. What went wrong was the subject of debate then and has been ever since. Your odds of avoiding such disruptions over the course of a long lifetime are virtually zero. Looming Recession The market for durable goods that drove the booming industrial economy in the s was already slowing by the time President Hoover took office. Durables are appliances, radios, cars, etc.

One problem was that the goods were a bit too durable. That decline in aggregate demand caused a moderate recession that was brewing prior to the Stock Market Crash of October Another problem was that for those that could afford goods, the s boom was credit driven, with many of the appliances and cars bought on installment plans. Buy Now Pay Later — a concept virtually unknown in many parts of the world to this day — was an all-too-familiar phrase in America by the end of the s.

There was a real estate bubble caused mainly by the Florida Land Boom. Immigration, meanwhile, was at a standstill because of the Immigration Act of It turns out, xenophobia was bad for the housing industry. And, just as durable goods installment plans were unforgiving, homeowners faced higher payments on shorter loans than the and year mortgages common today. Unsurprisingly, construction was sluggish by late Then drought started to plague agriculture in the late s.

They were already in debt when the Dust Bowl hit, starting in The success of assembly line-driven industries offset the declining farming sector for a while, but capitalism is cyclical.

Moreover, the downturn was international in scope, especially with Germany unable to get out from under the huge debt the Allies heaped upon it after WWI. What had been the emerging industrial power of central Europe rallied briefly in the mids but was struggling by Also doing poorly were the new countries carved out of the former Austro-Hungarian Empire at the Versailles Conference, like Poland and Czechoslovakia.

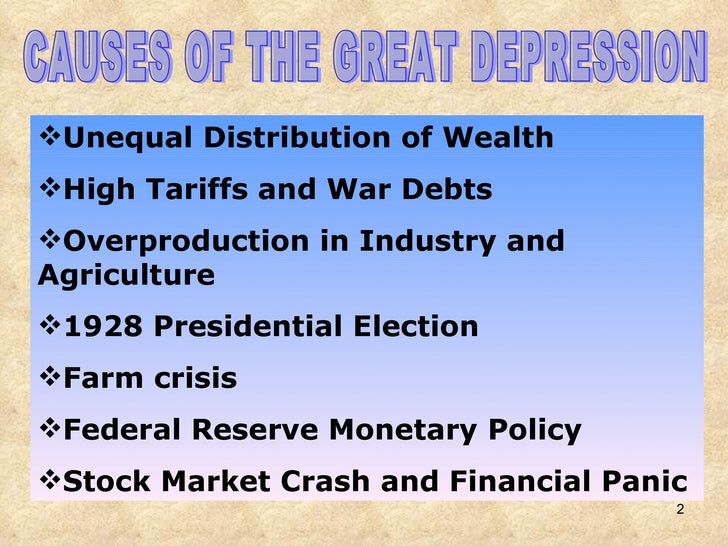

Stock Market Shenanigans Closer to home, financial markets were out of whack. The stock market was in a speculative bubble as opposed to a purely growth-driven upswing.

Stock shares are tiny slices of companies anyone can buy if a company is public rather than privately owned. Such pool operators could make money virtually at will in pump and dumps , to use the modern phrase for manipulating small stocks.

The idea was to drive the price of a stock up, then sell it before it went back down. Waldorf-Astoria Hotel Employees Operate Tickers and Stock Exchange Boards, , U.

No organized crime syndicates or counterfeiters in history have ever come up with a racket as profitable as manipulating stock prices.

Al Capone must have been back in Chicago in the s wondering why he was working so hard making a dishonest living bootlegging alcohol when the easy money could be made on Wall Street. Capone had to manage a vast distribution network, all the while keeping competition and law at bay with a small army of Tommy Gun-toting thugs. Pool operators, conversely, just planted a few well-placed rumors and then sat back running the ticker through their fingers while puffing a cigar and chuckling to themselves.

In fact, many of the operators ended up being the biggest victims Durant died penniless. They are as unlikely to not burst as you are likely to blow gum into an infinitely expanding bubble that never pops and covers your face in pink goo. The Internet caused similar exuberance in the s, leading to similar but less catastrophic results.

Overall productivity and growth have continued upward, so far, since the Market Revolution started at the end of the 18th century and the Internet has kept expanding. In those cases, a correction is inevitable. Morgan photographed by Edward Steichen in ; photo known for the light reflected off the armrest being interpreted by viewers as a knife. Even earlier, as Secretary of Commerce under President Warren Harding, Hoover warned that stock speculation was getting out of hand.

He asked writers to editorialize on the dangers of the Wall Street bubble. Fearing such talk would itself set off a panic, the establishment collectively told Hoover to shut his pie hole. Morgan encouraged Hoover to take a cue from his predecessors, Harding and Calvin Coolidge, and mind his own business. Mellon, who made his own fortune in steel and banking, also cut taxes — especially for earned income, as opposed to investments — from their high WWI-era levels, and had moderate success reducing the budget deficit early in his tenure.

Margin investing worked fine as the market continued upward and stock price appreciation exceeded the marginal loan rates. Since marginal investing was so widespread, this triggered a cascading effect once the market dropped. Still, brokers encouraged customers to borrow so they could invest more and the brokers got their commission fees.

The ringleader was Charles Mitchell of National City Bank now Citi , whose bank became the largest issuer of securities in the world and who pioneered selling stock to small investors. Citi also contributed to the financial crisis of but balanced these sins off by helping fund the Transatlantic Telegraph Cable in and Panama Canal in By , more money was lent to on-margin investors than the entire amount of cash circulating in the country.

Evangeline Adams , an astrologer supposedly descended from John Quincy Adams, offered investing tips in a regular column, usually Buy More.

Cruise ships in the Atlantic had minute-to-minute updates radioed in. It was almost like today, except that now people can follow prices on an up-to-the-millisecond basis with the right hardware they installed revamped fiber-optic cable between New York and Chicago in Additionally, companies began offering stock purchase plans , much to the dismay of labor unions who saw such plans as a ploy to co-opt workers.

He did just that, selling stocks and even selling short in time to profit from the downturn. Some of the big bankers that were propping up the market the previous Thursday started liquidating their own portfolios, even as they increased loans to stave off a run on cash. The Reserve banks Chapter 5 madly bought up bonds to re-inject cash into the system.

Fatigued brokerage staffs across the country spent days trying to sift through the high volume of trades. Some trades never executed while other customers had their entire portfolios sold multiple times. Chicago police prepared for rioting as gangsters absorbed big losses in their margin accounts.

The New York Times predicted it would cause a downturn in consumer spending on luxury items, but not much else, underestimating its impact on middle and working-class America. Similar downturns had occurred before and most people thought this one would correct itself soon enough. Now, at least, stocks would sell based on sound earnings fundamentals rather than speculation.

At the end of , the Times announced their annual biggest story of the year: Byrd, by the way, had regular stock quotes radioed to his Little America station at the South Pole. The market rebounded some by early , and many commentators thought the hiccup would be no worse than the previous downturn in The depression is over.

The crash reduced millions of people to paupers within a matter of months, both rich and middle-class. Remember Clarence Birdseye from the previous chapter? He sold his frozen packaged foods business and put all his money in stocks just before the crash. English politician Winston Churchill had most of his money in the market. The downturn reduced consumer spending, even as a normal recession was already in the works prior to Black Tuesday.

Corporations invest in other corporations, too, so the crash further depleted their coffers. Market sell-offs are especially hard on capital-dependent businesses like banks. Most investors were shy about investing after the October crash, despite cheap prices, because of continued uncertainty. You could think of that as another drop-off in consumer spending. Banks invest, too, and loan to corporations and individuals and small businesses. There was no Quantitative Easing as seen from , to inject cash into the banking system by buying up bonds and other assets.

In , the influential governor of the New York branch of the Federal Reserve, Benjamin Strong , promoted exactly such low interest rates in an effort to help Britain and France pay off their war debts to the U.

But Strong died in from complications of tuberculosis and morphine addiction and the Fed reversed its policies. Their tight-money policy was in step with other central banks in England and Europe that feared inflation and tied currencies to gold bullion not coins, because bars are easier for governments and central banks to control.

England reverted to its original pre-WWI gold-sterling pound standard, causing a gold shortage and a run on American gold. France, meanwhile, hoarded their gold and refused to sell. The Fed waffled during the downward spiral triggered by the recession, Stock Market Crash, and early bank failures.

They feared that foreign countries would swap dollars for gold, depleting the supply. The gold standard was a straightjacket, inhibiting growth, partly because they pegged gold to pre-WWI currency levels that were too low the U. Before that, private financiers like J.

Criticism of the Federal Reserve - Wikipedia

Morgan provided liquidity on their own to stave off panics. Keynes called a liquidity trap. Depression Financial problems in markets and banking, combined with drops in consumer confidence, lead to contractions, or recessions.

Recessions could be thought of as downward spirals. The upside of capitalism is that the same process works in reverse, snowballing in a positive direction.

Usually, though, earnings drop even more than prices. Another problem with deflation is that the real value of debt rises as wages fall or stagnate. The reverse upside of inflation is that debts effectively go down in relation to wages as the value of currency drops. For that reason, governments sometimes deliberately trigger inflation by printing money in order to lessen the impact of their own debts.

Why buy a car this month if it will be even cheaper next month? You can see why such fluctuations led the country to start the Federal Reserve in to stabilize currency as much as possible. In the early s, the downward effect of layoffs, hoarding, and lower spending spiraled worse than at any time in American history, the previous low being It was even worse, as you might expect, for minorities.

A migratory family living in a trailer in an open field. No sanitation, no water. They come from Amarillo, Texas. Henry Ford hoped to spur the economy with the introduction of his one-piece, flathead V-8 engine in — cheaper and bigger than previous eight-cylinder models sold by GM and used in planes and French cars. They could also steal cars as easily as horses because the new electric starters enabled enterprising thieves to bypass the ignition interlock and hot-wire the engine without a key.

Gangster John Dillinger even sent Ford a thank you letter for the V-8 evidently, police departments were behind the curve as tax revenues also fall during a recession.

Parolees asked to be put back in jail. Condom sales rose as birth-rates fell. Dust Bowl Making matters worse, drought plagued the Great Plains from the Texas Panhandle to the Canadian provinces. The end of WWI in Europe diminished the wheat market as war-ravaged countries eventually got back up on their feet and American rainfall decreased in the last half of the decade.

By , the USSR was exporting wheat to Europe at pre-war levels. In this case, the combination of better tractors, dropping wheat prices, and a worsening drought led to an unfortunate combination of technology and nature.

Loose topsoil blew around in massive dirt storms. You could tell the origin of the storm from the color of the soil e. Livestock wandered off or died of suffocation when dirt filled their nostrils. One storm blew all the way across the Midwest and East before dropping its dirt in the Atlantic Ocean, alerting politicians to the severity of the problem.

Static electricity in the storms killed vegetable gardens and jackrabbit and grasshopper plagues added to the misery. The Dust Bowl of destroyed thousands of uninsured farms in the Texas Panhandle and Oklahoma. Desperate Okies along with tenant farmers from Arkansas and southern Missouri loaded up their belongings and headed across the desert to the valleys of California to work as seasonal laborers in one of the biggest internal migrations in American history.

Watch The Warning Economic Collapse! The Federal Reserve Is Crashing The Stock MarketAround one-third of the farmers left the Dust Bowl-ravaged area. For those that stayed behind there was a silver lining in these red, black and brown clouds: Buy American Backfires Leaders and economists struggled to find a way out of the Depression. A natural impulse for citizens is to Buy American to save jobs.

In , congressional Republicans enacted more extreme legislation, passing the highest protective tariffs since Other business leaders and academics opposed the law and urged President Hoover to veto it.

Henry Ford spent an evening at the White House trying to talk sense into Hoover. The results were predictable and disastrous.

In fact, the League of Nations was trying to negotiate a tariff truce to stave off the worsening crisis just as Congress passed Smoot-Hawley. Along this line of thinking, Smoot-Hawley not only hurt the global economy, it undercut international cooperation at a time when the world needed more constructive interaction among nations. However, Nobel-winning economist Paul Krugman disagrees. He points out that because of the overall ongoing slowdown, world trade was declining at an even faster clip before Smoot-Hawley than after.

Critics of Smoot-Hawley are confusing cause and effect , according to Krugman. He argues that, while protectionism reduces efficiency, decline caused by a trade war should theoretically be mostly offset by increased opportunities for domestic growth e. Hoover Flounders Contrary to popular belief, both then and now, President Herbert Hoover was not a laissez-faire Republican in the mold of his predecessors, Harding and Coolidge.

He pressured companies to keep wages high even as their profits plummeted, inadvertently pricing workers out of the labor force. As we just saw, he signed off on the disastrous tariff increase. A significant recession in had turned around quickly on its own, after all.

Thus Hoover, being less of a purist than Mellon, met constantly with bankers, economists, and state politicians trying to find a solution. He encouraged local and state governments to initiate infrastructure projects. He wanted to create jobs on a large scale, but Congress rejected his ideas to build an interstate highway system and broaden the St.

Lawrence River to connect the Atlantic Ocean and Great Lakes for oceangoing ships replacing the smaller, outdated Erie Canal. The 71st and 72nd Congresses were factious in the early years of the Depression, offering little in the way of solutions to the public or President Hoover. Dwight Eisenhower got both the interstate and St. Lawrence River measures approved in the s — the former constituting the largest federal project in American history — but that was too late to help Hoover or the people in the early s.

The president was laissez-faire himself when it came to welfare. Hoover steadfastly refused direct federal relief to those suffering, arguing it was un-American and that they were too proud to take it anyway or, if not, should be. He and Congress set up an unprecedented organization, the Reconstruction Finance Corporation RFC to bailout the banking industry through government loans and investments and create public works projects to spur employment by investing in utilities and infrastructure, including railroads.

Neither of the two big public projects of the early s was overseen by the RFC. Boulder Dam now Hoover Dam was the biggest of the era, but the Bureau of Reclamation contracted to have it built before the Depression. The RFC worked well as far as it went.

For a while, the overall rate of bank failure fell from 70 to 1 per week and it saved one major Chicago bank Central Republic. Bank failures were on the rise again by the time he left office. Still, the idea of government investing in , rather than simply bailing out , companies had a lasting impact.

In both cases, the government earned its money back. Hooverville on Duwamish Tidal Flats, Seattle, , Washington State Archives. As a private citizen, Hoover was a legendary humanitarian in his day, feeding millions in Europe after WWI from his own pocket and leading government-sanctioned relief efforts.

The first president born west of the Mississippi, he was adopted by Iowa Quakers as an orphan, studied engineering at Stanford, and became one of the most successful mining engineers in the world around the turn of the century, famous in Australia and China. A survivor of the Boxer Rebellion Chapter 3 , Hoover became one of the greatest secretaries of commerce in history, helping to fuel the prosperous s through standardization in fields like communication and transportation.

But since he resisted direct relief in the Depression, though, the public naturally turned on him, blaming him for not doing enough as they grew hungrier and angrier. A few thousand even starved to death, and millions more went hungry and suffered from malnutrition.

Bonus Army March The most famous Hoovervilles were in Washington, D. In the Bonus Army March , WWI veterans came to the capital demanding early payment of bonuses due 13 years later, in see video below. They camped out on the Mall and in Anacostia Flats across the Potomac River while Congress debated the matter. The House of Representatives passed a resolution authorizing the payments but the Senate blocked it.

Hoover ordered them evicted, which the police and Army did see photo at the top of the chapter. Young soldiers burned encampments and turned fire-hoses on their older veteran counterparts. Can you imagine such a scenario today, with the military attacking and burning down the camps of veterans? In , though, that same Franklin Roosevelt benefitted from the fiasco.

Stock Market Crash Date, Causes

He was the Democratic candidate running against Hoover that fall. At their funeral, fellow employees sang the communist anthem Internationale. This happened in the United States. These two incidents, along with the food lines and the hobos, indicate that the country was in the midst of its deepest crisis since the Civil War. Bonus Army Shacks on the Anacostia Flats, Washington, D. Conclusion By the end of his term, Hoover was at a loss, despite being the first president in history to try and take action to alleviate a recession.

Perhaps he was waiting for another Hoover to come along, the way he had at the end of the WWI. However, charities and the private sector produced no such white knights and the scale of the problem far outstripped the resources of charities. One primary problem, it seemed, was the connection of cyclical markets and investment banks to commercial banks, where regular people kept their money instead of stashing it under the mattress where it could be stolen, burned, or eaten away more gradually by inflation.

While slavery was the underlying cause of the Civil War, the immediate cause was secession. But its most immediate cause was bank failures. Similar problems were happening in other countries, especially Germany but also Brazil, Poland, Canada, Argentina, and across Southeast Asia.

In May , a run on a major Austrian bank, the Creditanstalt , triggered panic across Europe and in Britain. In a democracy, voters would never stand for doing nothing even if that really would solve things faster than tinkering. By , many people were in desperate straits and demanding a dramatic change in government strategy — starting with some food. Paul Getty Museum B. What Can Past Droughts Tell Us About Tomorrow?

Stock Market Crash of October - Social Welfare History Project

History Hub Cameron Addis, Ph. Menu Skip to content Home C. Syllabi-Guides Distance Learning DIL Syllabi Lecture Class Syllabus Lecture Class Syllabus Lecture Class Argumentative Essay DIL Reading List DIL Reading List What Is A Good Analytical Paragraph? What Is A Primary Source? Andrew Mellon, , Trinity Court Studio, Pittsburgh, PA. Rescue Society in New York City, , Wikipedia Commons. Dust Bowl, Dallas, South Dakota, New York Times Coverage of Smoot-Hawley Tariff Debate.

Herbert Hoover, , U. Proudly powered by WordPress.