Ratio spread option strategy

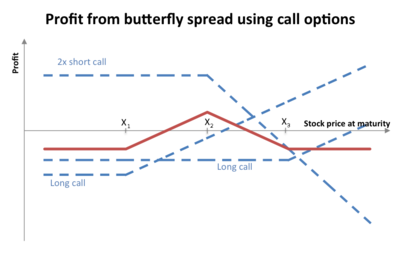

Ratio spreads are neutral in the sense that you don't want the market to move much either way once you make the trade. While call and put ratio spreads can be effective strategies when you are expecting relatively stable prices over the short term, they are not without risk.

Ratio Spread

By definition, a ratio spread involves more short than long options. If the trade moves against you, the extra short option s expose you to unlimited risk.

You might want to also review a call back spread , which is a ratio spread that involves more long than short options.

As such, it is a limited risk, unlimited reward strategy. To create a put ratio spread, you would buy puts at a higher strike and sell a greater number of puts at a lower strike. Ideally, this trade will be initiated for a minimal debit or, if possible, a small credit. This way, if the stock jumps, you won't suffer much because all of the puts will expire worthless.

However, if the stock plummets, you have unlimited risk to the downside because you will have sold more options than you bought. For maximum profitability, you want the stock price to stay at the strike price where you are short options.

Using Merrill Lynch MER , we can create a put ratio spread using in-the-money options. A big move to the downside in this case would spell trouble.

The downside breakeven point occurs when the stock price equals Didn't find what you needed? Content and tools are provided for educational and informational purposes only.

Any stock, options, or futures symbols displayed are for illustrative purposes only and are not intended to portray a recommendation to buy or sell a particular security.

Products and services intended for U. Online trading has inherent risk.

Backspread - Wikipedia

System response and access times that may vary due to market conditions, system performance, volume and other factors. Options and futures involve risk and are not suitable for all investors.

Short Ratio Call Spread

Please read Characteristics and Risks of Standardized Options and Risk Disclosure Statement for Futures and Options on our website, prior to applying for an account, also available by calling An investor should understand these and additional risks before trading. Multiple leg options strategies will involve multiple commissions.

Member SIPC "Schwab" and optionsXpress, Inc. Deposit and lending products and services are offered by Charles Schwab Bank, Member FDIC and an Equal Housing Lender "Schwab Bank". Put Ratio Spread To create a put ratio spread, you would buy puts at a higher strike and sell a greater number of puts at a lower strike.

Example Using Merrill Lynch MER , we can create a put ratio spread using in-the-money options.