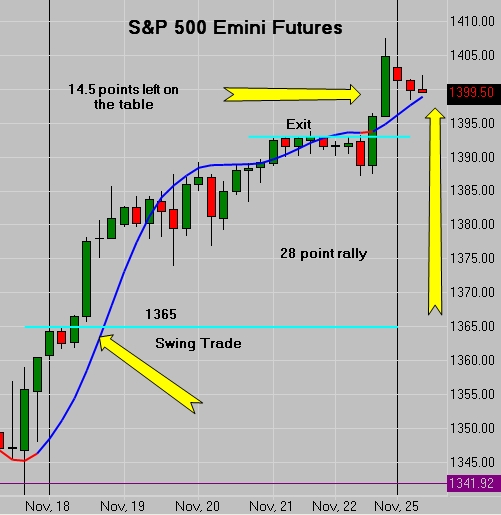

Swing trading emini futures

The futures market—where global commodities such as coffee, corn, soybeans, oil and gold trade—is a very popular day trading and swing trading market. Swing trading is when you take trades that last a couple days to a couple months.

Futures are popular because a futures contract is inherently leveraged. That means returns can be very big compared to capital used. As oil fluctuates, what you can sell your barrels for goes up or down, creating a profitable or losing position for you.

A better option is to buy an oil futures contract CL.

It gives you exposure to barrels of oil, but you only need to put up a small fraction of the full cost of the barrels. This is why futures are so popular for swing trading. So what is the downside? While returns can add up quickly, so can losses. Maintenance Margin is how much capital you need to have in your account while holding a futures trade. It is usually a bit below the Initial Margin amount.

Swing Trading Futures emini S&P | Elite Trader

As a recap, Initial Margin is how much you need in your account to open a futures contract trade. Maintenance Margin is how much you need in your account during a trade. If your account falls below the Maintenance Margin level, you must deposit enough capital to bring your balance up to the Initial Margin level, otherwise your trade will be closed by the broker.

Here is an example of the different Initial and Maintenance Margin levels for various futures contracts intraday margin is applicable if you open and close your position within the same day—day trading.

Futures Margin Requirements — NinjaTrader subject to change. See full product margin list: This section looks at how much capital you need based on where you place your stop loss, and how much capital from your account you are willing to risk on each trade.

These two factors are key in assessing how much capital you need to swing trade with. Other popular contracts, along with their specifications and the recommend swing trading capital required, are discussed below. Futures contracts move in increments called ticks and points.

In different contracts, the ticks and points are worth different amounts. Interested in getting a futures trading mentor? See who I recommend. It is recommended that swing traders have both an entry and exit plan when they enter a trade. This means you will place your entry, and at the same time place a stop loss order and target order.

If you buy one ES contract at A swing trader will likely need to place their stop loss at least 2 points away from their entry point on ES.

That is the absolute minimum distance you should place a stop loss away from your entry point. It is more likely your stop loss will be 3, 4 or 5 points away from your entry when swing trading.

The next step is to determine how much of your account, in percentage terms, you are willing to risk on each trade. That way, even if you hit a string of losing trades , most of your capital will still be intact. Losing trades happen to everyone, and losing a big chunk of money is hard to recover from. To figure out exactly how much capital you need, you will need to do some testing and strategizing to figure out what your typical stop loss is going to be 3.

The above assessment is likely an absolute minimum for most people. There may be great opportunities that require a stop loss be placed 3, 4, 5, 6 or even 8 points from your entry. That way, if you end losing a few trades, you still have ample capital to cover your initial and maintenance margins.

That way, if you end up losing a few trades, you still have ample capital to cover your initial and maintenance margins. The stop losses are based on my own trading, using a 1-hour chart for finding entries. The stop loss you require for your strategy may differ. During volatile times your stop loss may need to be bigger, requiring more capital.

During quieter times your stop loss could be smaller, meaning you need less capital than described above. Gold Futures GC — Represent ounces of gold.

E-Micro Gold Futures are a smaller gold futures contract.

Silver Futures SI — Represent 5, ounces of silver. You will likely need a stop loss that is at least 0.

Swing Trading in Commodities

More likely your stop loss will be 0. For other the specifications of other contracts visit CME Group or Intercontinental Exchange.

Pull Back Swing Trading Strategy I The Only Way To Trade Stocks and E-Mini Retracement.To swing trade futures, you are still putting up a hefty amount of cash. Make sure that every trade you take has the potential to compensate you for that risk. This will cover your initial margins on all futures contracts discussed above, and keep your risk on each trade to a small percentage of account capital.

The scenarios above make certain assumptions, such as how far your stop loss is from your entry point. This will vary by strategy. These estimates are based on how I swing trade. During quieter times your stop loss may be smaller, meaning you need less capital than described above.

Striker - Striker Securities - Futures Trade Systems, Commodity Trading, Alternative Investments

Futures are great, and I day trade and swing trade them regularly. My favorite market is still forex though. How Much Money Do I Need to Swing Trade Futures? Posted on September 10, by Cory Mitchell, CMT.

Basic Introduction to Futures Trading Futures are popular because a futures contract is inherently leveraged. Leave a Reply Cancel reply document. Sign Up for Our Free Trading Newsletter. How to Day Trade Stocks In Two Hours or Less Extensive Guide How Much Money Do I Need to Trade Forex?

Day Trading Stock Picks for Week of June 20 Why Day Traders Can Make Big Returns, But Aren't Millionaires. Trading Courses Trading Tutorials Free Trading eBooks Canadian Investor Forex Stats About Us.