Matlab american call option

Determine American call option prices or sensitivities using Roll-Geske-Whaley option pricing model - MATLAB optstocksensbyrgw - MathWorks France

This tutorial presents MATLAB code that implements the Cox Ross Rubinstein CRR version of the binomial model as discussed in the Cox Ross Rubinstein section of the Binomial model tutorial. The code may be used to price vanilla European or American, Put or Call, options.

Given appropriate input parameters a full lattice of prices for the underlying asset is calculated, and backwards induction is used to calculate an option price at each node in the lattice. Creating a full lattice is wasteful of memory and computation time when only the option price is required. However the code could easily be modified to show how the price evolves matlab american call option time in which case the full lattices would be required.

Note that the primary purpose of the matlab american call option is to show how to implement the Cox Ross Rubinstein binomial model.

The code contains beginners binary options trading strategies youtube error checking and is not optimized for speed or memory use. As such it is not suitable for inclusion into a larger application without modifications. A MATLAB function called binPriceCRR is given below.

Option pricing package - File Exchange - MATLAB Central

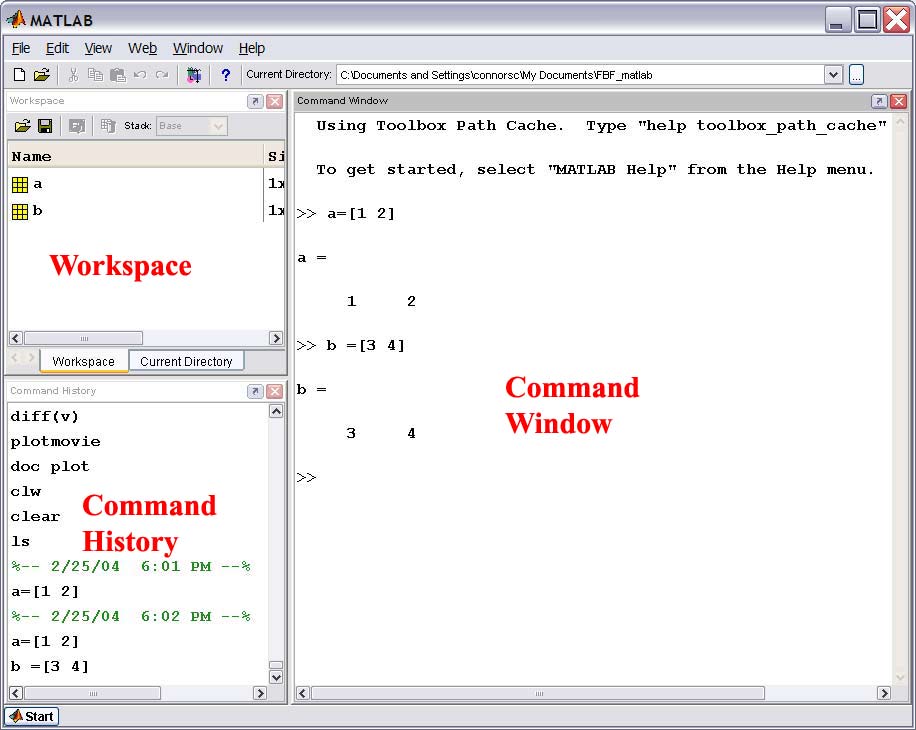

The following shows an example of executing binPriceCRR and pricing the above option in MATLAB. Back To Top Option Pricing.

Cox Ross Rubinstein in MATLAB This tutorial presents MATLAB code that implements the Cox Ross Rubinstein CRR version of the binomial model as discussed in the Cox Ross Rubinstein section of the Binomial model tutorial. Phil Goddard phil goddardconsulting.