Cci trading forex

Commodity Channel Index Strategy - How to Use the CCI in Forex Trading

Yen Aims to Extend Gains, Pound Focus Shifts Back to Politics. Gold Prices May Find a Lifeline as Market Mood Darkens. Loonie Slides as Crude Dives- USDCAD Recovery Eyes Resistance.

Gold, USD Strong Inverse Correlation and in Confluence.

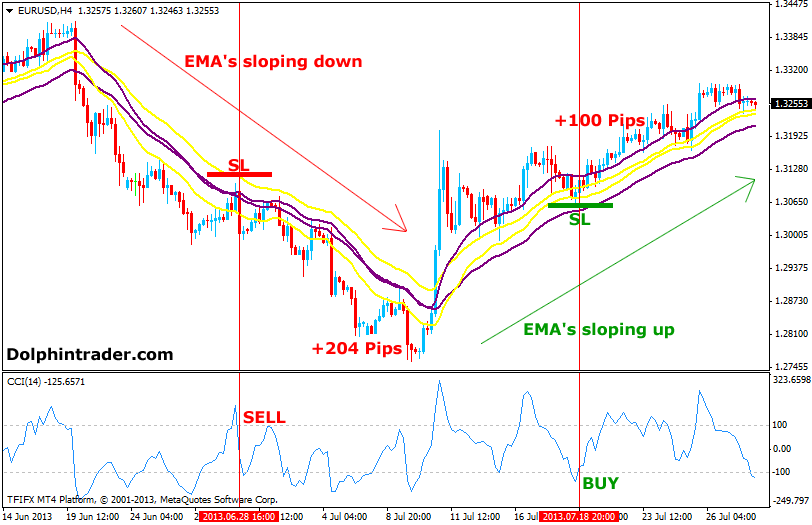

FTSE Further Develops Range on Sharp Turn Lower. Dow Jones Industrial Average Struggles to Hold the Gap Higher. CCI is a popular indicator used by Forex traders to identify oversold and over bought conditions much in the same way that RSI or Stochastics is used.

Though Donald Lambert created CCI back in to identify cyclical turns in commodities it is very effective with currencies. By measuring the current price relative to the average price of a set period like 14, CCI is low during time prices are below their average and high when prices are above their average.

This gives us the oversold and overbought regions. Why is this important you may ask? Well, it is simple. When we have a strong uptrend, the best place to buy is at price point where traders are no longer selling or selling pressure begins to subside.

Hughes Optioneering

How do we know when something is oversold? This is a great question too! Forex traders have several tools and methods at their disposal to show them when prices have fallen too far too fast and when bargain hunters may step in sending prices higher. With CCI, Forex traders look to buy when CCI crosses above Like the real estate investor, we look for the value of our holdings to increase over time. Since we have bought at a relatively low price, our risk is small relative to the potential gain.

Unlike real estate fixer-uppers, Forex traders can forget remodeling as time and trend work to increase the value of the position. GBP USD CCI Buy Signals. The current trading setup below shows a GBPUSD daily chart uptrend from August The chart depicts four successful by signals given by CCI as it crossed dow n below the line and turned up.

In an uptrend, traders Forex Traders will take buy signals using CCI and use CCI sell signals to take profits. Waiting for CCI to turn above and looking for price to confirm the move, traders will enter the market long and then place a protective stop order about pips below the last swing low. Currently, GBPUSD has just bounce from the 1.

How to Trade Commodity Channel Index (CCI) in Forex

A stop could be placed just below that swing low for a target of 1. If the stop is hit, then we look for another trade! CCI is simple way to visually identify potential entries. This article showed you how to use CCI to trade the strong GBPUSD trend.

I want to invite you to enroll in our free CCI Course to give you additional practice using CCI buy and sell signals. Sign our Guestbook to gain access to this course that will help you get up to speed on Forex market basics. You can master the material all while earning your completion certificate.

Register HERE to start your Forex learning now! DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Market News Headlines getFormatDate 'Wed Jun 21 Technical Analysis Headlines getFormatDate 'Wed Jun 21 Gold, USD Strong Inverse Correlation and in Confluence getFormatDate 'Wed Jun 21 Education Beginner Intermediate Advanced Expert Free Trading Guides.

News getFormatDate 'Wed Jun 21 News getFormatDate 'Tue Jun 20 Talking Points - Since the July lows, GBPUSD has rallied pips in a strong uptrend. Upcoming Events Economic Event. Forex Economic Calendar A: NEWS Articles Real Time News Daily Briefings Forecasts DailyFX Authors.

Financial Trading with Tight, Fixed Spreads | Core Spreads

CALENDAR Economic Calendar Webinar Calendar Central Bank Rates Dividend Calendar. EDUCATION Forex Trading University Trading Guide. DAILYFX PLUS RATES CHARTS RSS. DailyFX is the news and education website of IG Group.