Related diversification strategy ppt

Slideshare uses cookies to improve functionality and performance, and to provide you with relevant advertising. If you continue browsing the site, you agree to the use of cookies on this website. See our User Agreement and Privacy Policy. See our Privacy Policy and User Agreement for details. Published on Jan 9, Clipping is a handy way to collect and organize the most important slides from a presentation.

You can keep your great finds in clipboards organized around topics. SlideShare Explore Search You. Show related SlideShares at end.

Full Name Comment goes here. Are you sure you want to Yes No. Akshada Pednekar , Student at School of Health Care Administration, regional center Pune.

Saumya Rao , Student at Shaheed Sukhdev College Of Business Studies at Development Alternatives. DEVAIYA Nikhil , Attended C. Embeds 0 No embeds. No notes for slide. Strategy Formulation Strategies for Growth and Diversification 2.

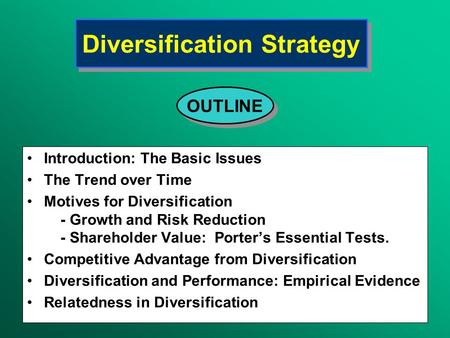

Identifying Growth StrategiesDefine the industryAnalyze options for growth 3. What Is Our Industry? Defining the industry in new ways canpresent new opportunities. When Does Diversification Make Sense? Diversification -- MotivesThe risks of single business strategies aremore severe for management than forshareholders of publicly traded firms.

Diversification only makes sense when itenhances shareholder value! Tests For Judging Diversification Attractiveness Better-off Cost of entry Attractiveness TestIs the target industry attractive?

Diversification |authorSTREAM

Use 5-forces model to assess industryattractiveness Does the diversification move fit with thegrand strategy of the firm? Better-off testDoes the diversification move produceopportunities for synergies?

Will thecompany be better off after thediversification than it was before? Cost of Entry TestIs the cost of the diversification worth it? Will the diversified firm create enoughadditional value to justify the cost? Methods for DiversificationAcquisition of an existing businessCreation of a new business from within, e.

Frank Denneman

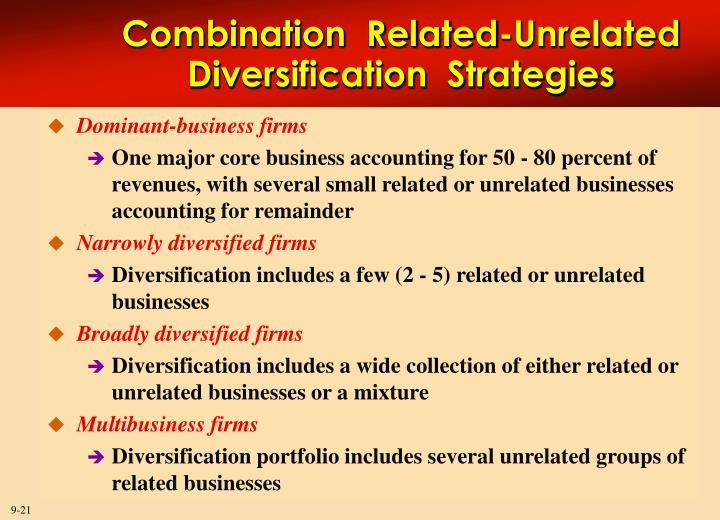

AcquisitionMost popular approach to diversificationQuick market entryAvoids entry barriers: Major Acquisition Issue Acquire a successful company at a high price orAcquire a struggling company at a bargain price You have time to launch Market moves slowly Internal entry costs lower than acquisition costs You already possess necessary skills Target industry is fragmented Therefore, they tend to exploit economies of scopeTend to historically outperform unrelated diversifications Unrelated DiversificationNo common linkage or element of strategic fit among SBUs -- i.

Corporate Strategy for Diversified Firms -- Key Strategic Issues 1 How attractive are our current businesses? Industry growth rate Relative market share position of the businessesSBUs plotted as circles with area proportional to theircontribution to overall corporate sales Strategic Implications of the G.

Life-Cycle Portfolio Matrix SBUs Competitive Position Strong Average Weak Introduction GrowthLife-Cycle Early MaturityStages Late Maturity Decline Common Problems Associated With Diversified Firms: Market CriteriaFuture projectionReflects anticipated resultsIndicates investor confidenceMeasures: ROE, ROI, ROA, market share,revenue, operating margin profit , time-to-market, inventory turns, quality, etc.

Start clipping No thanks. You just clipped your first slide! Clipping is a handy way to collect important slides you want to go back to later. Now customize the name of a clipboard to store your clips. Visibility Others can see my Clipboard.